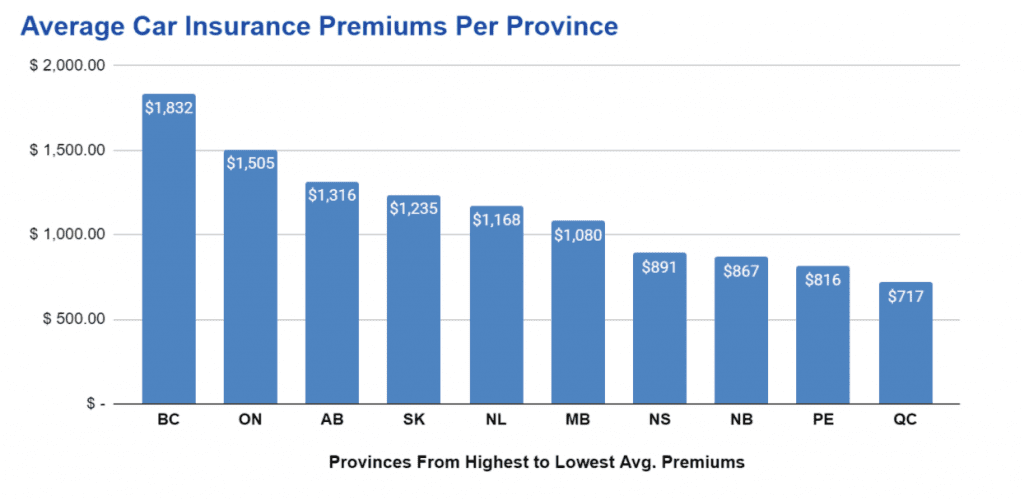

In Canada, each province regulates the types of mandatory insurance and the average cost of insurance premiums. Provinces like Ontario and British Columbia have higher insurance premiums as a result of the higher insurance claims and fraud occurrences. Newfoundland has the highest insurance premium of the maritime provinces because the claims for bodily injury cost a lot more. Lawsuits have also been known to drive the average cost of insurance premiums as well. The graph below shows the average cost of car insurance premiums for each province in Canada. The average car insurance premiums were calculated by dividing the total cost of all insurance premiums in each province by the total number of registered vehicles within each province.

Are Auto Insurance Policies Offered Through Public or Private Lenders?

In Canada certain provinces will offer both public and private auto insurance however, not all provinces in Canada have public auto insurance available. Public auto insurance is provided by financial institutions and insurance firms that are government-owned. Whereas, private auto insurance is provided by privatized lenders, financial institutions, and insurance firms. In provinces that offer both public and private auto insurance, mandatory coverage will be available through government-owned insurance firms. Any other insurance policies that are not under the mandatory auto insurance policies will be available at privatized financial institutions and insurance firms. Only the provinces; BC, MB, QC, and SK. All the other provinces have auto insurance available through private auto insurance only as displayed in the table below.

Private and Public Auto Insurance Available in Canada

Private Auto Insurance

Public Auto Insurance

Alberta

British Columbia

Manitoba

New Brunswick

Newfoundland & Labrador

Nova Scotia

Ontario

Prince Edward Island

Quebec

Saskatchewan

Northwest Territories

Nunavut

Yukon

Note: Quebec’s public car insurance is only accidental benefits coverage.

Get An Auto Insurance Quote In Just 5 Minutes Today With Sonnet!

Here at Sonnet we have auto insurance online available in Alberta, Quebec, Ontario, New Brunswick, Nova Scotia or P.E.I provinces. With our competitive and personalized pricing, you can save even more on our auto insurance. Getting auto insurance has never been so easy to apply online with us today!