COMPARE LOANS

Compare Unsecured Personal Loan Deals Across Canada

- Quick and easy to use

- Loan offers for all credit scores

- Doesn't harm your credit score

We compare personal loan offers from the largest range of lenders in Canada

We partner with over 20 lenders in Canada to get you the best deals whether you want to consolidate your debt, pay your bills, pay off credit cards or just have extra money for an upcoming expense

What is a personal loan?

What is a personal loan?

A personal loan is money borrowed from a bank, credit union or online lender that you pay back in fixed monthly payments, or installments, typically over two to five years. The interest rate on a personal loan is usually fixed, meaning it will not change over the life of the loan.

How do personal loans work?

These types of loans are usually unsecured loans which means you don’t need to put up an asset or security (like a car or a house) in order to get the loan. The flip side of that is that you would be limited in the amount you are able to borrow, most lenders are in the range of $500 to $50,000. The amount you would be able to borrow depends on a few factors but ultimately the question the lenders are trying to answer is how likely are you to pay back the loan.

Apply for your loan using one application

We have one simple application that will ask you some basic questions such as how much you need, your contact details and what your employment and income statuses are.

We search the market with one click

We will find you the best lenders that meet your needs and give you the highest chance of approval

You will be matched with the lender most likely to approve you

After you have been matched to the lender you will be need to fill out a few more details including where they would send you the funds

What can I use the money for?

You can use the money for a number of different reasons here are some of the most common reasons in Canada.

To sell more quickly with a bridging loan

A bridging loan can help you to buy a new property before you sell your current home, by ‘bridging’ the gap between sale and completion.

To consolidate existing debts

Debt consolidation is one of the most popular reasons why people apply for a personal loan they take a large lump sum of money and use it to pay off multiple forms of debt that way it's much easier for them to manage and make sure they don't miss any payments.

Bill Payment

Internet? Car bill? Cell phone? The stress of having to make the smaller payments adds up over time, our short term installment loans can help you get caught up.

Home Remodelling

You can use a personal loan to upgrade your house or pay for any repairs that need to be done such as heating or plumbing.

Vehicle financing

Personal loans are one way to cover the cost of a car, a boat or an RV. It is a great way to pay for a vehicle if you're not buying it from the company directly or don't have financing from them.

Unexpected Expense

Sometimes life throws you a curveball and an expense you didn't plan for shows up. Short-term installment loans can help you get by and repaying them regularly and on time will help build your credit score over time.

What types of loans are available?

There are many loans available in Canada. They differ in lending criteria, loan amounts and what kind of security they might need from you.

Unsecured or personal loans

An unsecured loan is exactly as it sounds like you aren't required to put up any kind of collateral in order to borrow money. The lender is going to offer you money based on your creditworthiness and on their assessment of your ability to repay the loan.

Secured or homeowner loans

Secured long is a loan that is backed by some type of collateral which is typically a financial asset that you own this can be your car or your home. Behind this type of loan is that in the event you default and don't make the payments the lender can take your collateral. The benefit to a secured loan is that the interest rate is usually a lot lower than an unsecured loan

Guarantor loans

Guarantor loans work in a way that if you don't have good credit or established credit but you still know that you would be a good borrower you can choose to find a friend or family member that will guarantee the loan for you. In the event that you don't make the payment your guarantor would need to make the payment for you which reduces the risk for the lenders.

Am I eligible for a loan with bad credit?

When you apply for a personal loan, the lenders are going to be looking at your credit and ability to pay back your loan. If you know you have a bad credit score, we have lenders that can help and they tend to look at you as a whole rather than just your credit score. Their programs and rates are all different which it is a good idea to compare your options through BestLendersFor to see what deal makes sense for your circumstances. The good news is that as you make payments back to your lender on time, they will report this to the credit bureaus which will lead to increases in your credit score over time.

Comparing your options with BestLendersFor could result in bigger savings in interest by finding a loan that works for you.

What will my loan cost?

It’s important for you to work out what your loan will cost you in terms of monthly repayments over the term. Whether you’re looking to take a £5,000 loan or even £15,000, our loans calculator can help you work out how much you can afford to borrow by entering how much you can afford to pay back each month and the length of time you can afford to pay that amount (and at what interest rate.)

It’s worth noting that smaller loans tend to have higher interest rates, which can affect the affordability of your loan – so if you take out a loan over a longer term you should be able to bring the repayments down.

Representative example |

||

|---|---|---|

| Loans Amount | Monthly repayments | Length of agreement |

| £10,000 | £179.07 | 60 months |

| Total amount repayable | Representative | Annual Rate of Interest (nominal) |

| £10,744.50 | 2.9% APR | 2.86% |

Grow your credit score for even better offers

Your credit score is a three digit number that basically resprents your likliness of paying back a loan on time. The higher your score, the more likely lenders will feel you will pay back your loan so their risk is lower. This leads to a lower interest rate than if you had a poor credit score.

It is important to know your score so you can monitor it and work on improving it over time. Check your score here, get regular updates and get tips that are personalized to you to help grow your score – all for free.

With a pre-approved loan, the deal you see is the deal you get

When you apply for a loan, it’s not always clear what deal you’ll be offered or whether you’ll be accepted. But when you’re pre-approved for a loan, you know the deal you see is the deal you’ll get – you’ll know where you stand, with information that will help you make the right choice.

Apply with confidence

When you’re pre-approved, the loan amount, duration and interest rate are all confirmed

Tailored to you

When you know what you’ll be able to borrow and how much it will cost, you can choose a loan that’s right for you

You’re in safe hands

This helps protect your credit score as you’re less likely to be rejected when you apply

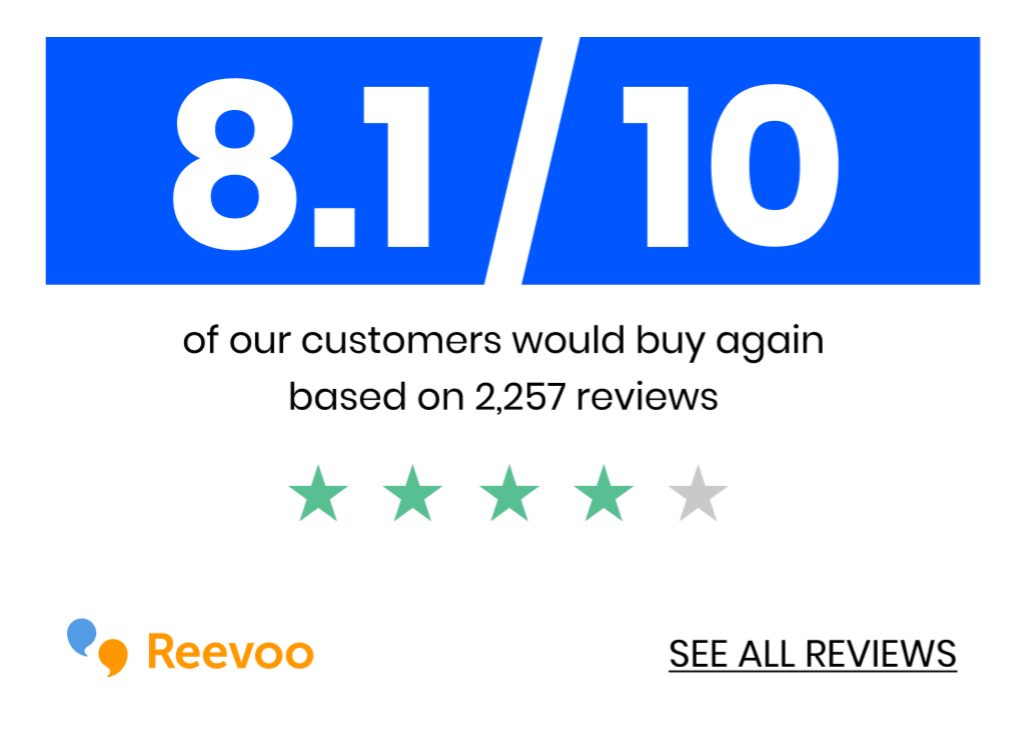

We're 100% independent, working only for our customers

Unlike some of our competitors, MoneySuperMarket is not owned by an insurance company. So we can offer the best value, with savings delivered straight to you.

We combine independence, so we can negotiate the best prices, with excellent technology, to find the best value products and services.

That makes us, in our customers’ opinions, the best price comparison website.

Reporting loan scams

We’re aware that some fraudsters are trying to use the MoneySuperMarket brand to trick consumers into handing over money or financial details, by offering fake loans with eye-catching interest rates.

The best way to stop these scams is to report them.

How do I report a loan scam?

If you think you’ve been contacted by a fraudster, please stop all communication with them and report it to Action Fraud.

If it’s someone impersonating BestLendersFor, please contact our customer services team.

Phone Action Fraud on

0300 123 2040 to report fraud

Find my score

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

What can I take out a loan for?

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

How much can I borrow?

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

How long can I take out a loan for?

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

How do I know if I’m eligible for a loan?

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

COMPARE LOANS

Compare Unsecured Personal Loan Deals Across Canada

- Quick and easy to use

- Loan offers for all credit scores

- Doesn't harm your credit score

We compare personal loan offers from the largest range of lenders in Canada

We partner with over 20 lenders in Canada to get you the best deals whether you want to consolidate your debt, pay your bills, pay off credit cards or just have extra money for an upcoming expense

What is a personal loan?

What is a personal loan?

A personal loan is money borrowed from a bank, credit union or online lender that you pay back in fixed monthly payments, or installments, typically over two to five years. The interest rate on a personal loan is usually fixed, meaning it will not change over the life of the loan.

How do personal loans work?

These types of loans are usually unsecured loans which means you don’t need to put up an asset or security (like a car or a house) in order to get the loan. The flip side of that is that you would be limited in the amount you are able to borrow, most lenders are in the range of $500 to $50,000. The amount you would be able to borrow depends on a few factors but ultimately the question the lenders are trying to answer is how likely are you to pay back the loan.

Apply for your loan using one application

We have one simple application that will ask you some basic questions such as how much you need, your contact details and what your employment and income statuses are.

We search the market with one click

We will find you the best lenders that meet your needs and give you the highest chance of approval

You will be matched with the lender most likely to approve you

After you have been matched to the lender you will be need to fill out a few more details including where they would send you the funds

What can I use the money for?

You can use the money for a number of different reasons here are some of the most common reasons in Canada.

To sell more quickly with a bridging loan

A bridging loan can help you to buy a new property before you sell your current home, by ‘bridging’ the gap between sale and completion.

To consolidate existing debts

Debt consolidation is one of the most popular reasons why people apply for a personal loan they take a large lump sum of money and use it to pay off multiple forms of debt that way it's much easier for them to manage and make sure they don't miss any payments.

Bill Payment

Internet? Car bill? Cell phone? The stress of having to make the smaller payments adds up over time, our short term installment loans can help you get caught up.

Home Remodelling

You can use a personal loan to upgrade your house or pay for any repairs that need to be done such as heating or plumbing.

Vehicle financing

Personal loans are one way to cover the cost of a car, a boat or an RV. It is a great way to pay for a vehicle if you're not buying it from the company directly or don't have financing from them.

Unexpected Expense

Sometimes life throws you a curveball and an expense you didn't plan for shows up. Short-term installment loans can help you get by and repaying them regularly and on time will help build your credit score over time.

What types of loans are available?

There are many loans available in Canada. They differ in lending criteria, loan amounts and what kind of security they might need from you.

Unsecured or personal loans

An unsecured loan is exactly as it sounds like you aren't required to put up any kind of collateral in order to borrow money. The lender is going to offer you money based on your creditworthiness and on their assessment of your ability to repay the loan.

Secured or homeowner loans

Secured long is a loan that is backed by some type of collateral which is typically a financial asset that you own this can be your car or your home. Behind this type of loan is that in the event you default and don't make the payments the lender can take your collateral. The benefit to a secured loan is that the interest rate is usually a lot lower than an unsecured loan

Guarantor loans

Guarantor loans work in a way that if you don't have good credit or established credit but you still know that you would be a good borrower you can choose to find a friend or family member that will guarantee the loan for you. In the event that you don't make the payment your guarantor would need to make the payment for you which reduces the risk for the lenders.

Am I eligible for a loan with bad credit?

When you apply for a personal loan, the lenders are going to be looking at your credit and ability to pay back your loan. If you know you have a bad credit score, we have lenders that can help and they tend to look at you as a whole rather than just your credit score. Their programs and rates are all different which it is a good idea to compare your options through BestLendersFor to see what deal makes sense for your circumstances. The good news is that as you make payments back to your lender on time, they will report this to the credit bureaus which will lead to increases in your credit score over time.

Comparing your options with BestLendersFor could result in bigger savings in interest by finding a loan that works for you.

What will my loan cost?

It’s important for you to work out what your loan will cost you in terms of monthly repayments over the term. Whether you’re looking to take a £5,000 loan or even £15,000, our loans calculator can help you work out how much you can afford to borrow by entering how much you can afford to pay back each month and the length of time you can afford to pay that amount (and at what interest rate.)

It’s worth noting that smaller loans tend to have higher interest rates, which can affect the affordability of your loan – so if you take out a loan over a longer term you should be able to bring the repayments down.

Representative example |

||

|---|---|---|

| Loans Amount | Monthly repayments | Length of agreement |

| £10,000 | £179.07 | 60 months |

| Total amount repayable | Representative | Annual Rate of Interest (nominal) |

| £10,744.50 | 2.9% APR | 2.86% |

Grow your credit score for even better offers

Your credit score is a three digit number that basically resprents your likliness of paying back a loan on time. The higher your score, the more likely lenders will feel you will pay back your loan so their risk is lower. This leads to a lower interest rate than if you had a poor credit score.

It is important to know your score so you can monitor it and work on improving it over time. Check your score here, get regular updates and get tips that are personalized to you to help grow your score – all for free.

With a pre-approved loan, the deal you see is the deal you get

When you apply for a loan, it’s not always clear what deal you’ll be offered or whether you’ll be accepted. But when you’re pre-approved for a loan, you know the deal you see is the deal you’ll get – you’ll know where you stand, with information that will help you make the right choice.

Apply with confidence

When you’re pre-approved, the loan amount, duration and interest rate are all confirmed

Tailored to you

When you know what you’ll be able to borrow and how much it will cost, you can choose a loan that’s right for you

You’re in safe hands

This helps protect your credit score as you’re less likely to be rejected when you apply

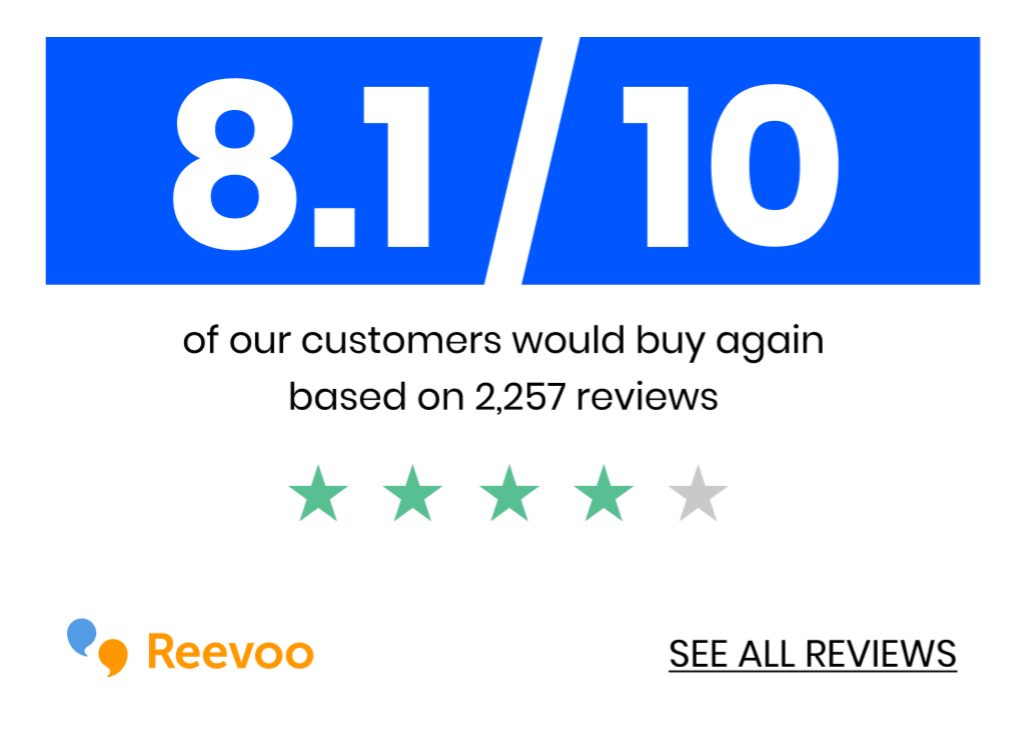

We're 100% independent, working only for our customers

Unlike some of our competitors, MoneySuperMarket is not owned by an insurance company. So we can offer the best value, with savings delivered straight to you.

We combine independence, so we can negotiate the best prices, with excellent technology, to find the best value products and services.

That makes us, in our customers’ opinions, the best price comparison website.

Reporting loan scams

We’re aware that some fraudsters are trying to use the MoneySuperMarket brand to trick consumers into handing over money or financial details, by offering fake loans with eye-catching interest rates.

The best way to stop these scams is to report them.

How do I report a loan scam?

If you think you’ve been contacted by a fraudster, please stop all communication with them and report it to Action Fraud.

If it’s someone impersonating BestLendersFor, please contact our customer services team.

Phone Action Fraud on

0300 123 2040 to report fraud

Find my score

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

What can I take out a loan for?

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

How much can I borrow?

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

How long can I take out a loan for?

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

How do I know if I’m eligible for a loan?

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.