Canada is made for driving. From the Atlantic to the Pacific, from the great white north to the bustling cities along the Great Lakes, Canadians are getting behind the wheel and enjoying the inspiring landscape of this vast country. No matter where you live, there’s a destination waiting for you. If all you’re missing is the right ride to take you there, LendingArch has you covered.

Sliding behind the wheel of a new car or truck can be a thrilling ride. Whether you’re blasting across the country or just getting your family around town, the vehicle you drive is an important and intimate part of your life. You need one that’s reliable, affordable, and makes sense for your individual lifestyle.

But, for many of us, even as we hear the freedom of the open road beckoning, the reality of affording that new car presents serious detours. Financing plans vary in their terms and lengths, and even determining what lies in your budget can be a real struggle. Monthly payments can be hard to meet, and interest rates can be punishing, especially for those buyers carrying the burden of bad credit.

Happily, the dream of hitting the highway doesn’t have to end just because you have a less than perfect credit history. If affording a new vehicle that fits within your monetary constraints poses a challenge, LendingArch is there to help.

LendingArch’s goal is to inspire and empower Canadians to find and purchase great vehicles with affordable, sensible financing plans that make sense for their individual needs.

We’ve thrown out the traditional lending model. Say goodbye to rejected applications and forget about invasive credit checks. Our process looks beyond just your credit score to see you as a person. We’ll work with you to develop a manageable payment plan with terms that make sense for your financial reality.

Once approved, we’ll connect you to a range of reputable lenders and dealers offering the top makes and models on the market today. We’ll make your search painless by presenting lots of options for finding the best rates, helping you shop with confidence knowing your finances won’t be thrown into a tailspin—even if you’re burdened with a not-so-sparkling credit score.

At LendingArch, we’re focused on the road ahead that awaits you, not the bumps and scrapes in your financial history.

LendingArch: Creating Possibilities In Your Province

LendingArch is there to help drivers with locations from east to west. No matter where your journey might take you, LendingArch is there with access to lots of local dealers and lenders who share our philosophy of putting drivers first.

Our services are available in locations across this great country. Imagine yourself on a road trip headed west, with LendingArch by your side and access to the best deals on the market.

Ontario

Ontario is the heart of central Canada and home of both busy metropolises and breathtaking outdoor locales. LendingArch is there to help drivers in Ontario find and finance top-rated vehicles, whether hitting the busy city streets or traversing the open wilderness.

In Toronto, drivers can make the commute in and out of Canada’s largest city a bit more tolerable with a stylish and comfortable ride. In Ottawa-Gatineau and neighbouring Kanata, the movers and shakers of the nation’s capital can access our huge vehicle database for a car that matches their lifestyle. Hamilton is becoming a thriving and diverse metropolis of its own, and we’re there to help drivers find their way.

LendingArch is connected to great dealers and lenders all over eastern Ontario. From Kingston to Belleville to Peterborough, we’ll hook you up with great vehicles at the fairest rates, making the ride down the 401 (or wherever you’re headed) a breezy ride.

Headed west, our dealer database gives access to dealers all around the Lake Ontario region. Drivers in Milton and Brantford can use our easy application process to find loan financing that works. The Kitchener-Waterloo-Cambridge, Stratford, Orangeville, and Guelph regions are growing fast, with families, professionals, and people from all walks of life seeking vehicles to accommodate their busy schedules. We’re there to help them, making searching for vehicles and car loan financing easy and quick.

Western Ontario is a growing region, thriving in education, medical, technology, and other industries presenting new opportunities. As it grows, more and more drivers require cars that meet their necessities, even when finances may be tight. LendingArch works with a philosophy that there’s a car out there for everyone, no matter their circumstances. We work with top dealers in London, Chatham, and Woodstock, bringing manageable payment plans and easy contract terms to all drivers. Our network extends all the way around Lake Ontario, down to Windsor, Sarnia, and the St. Catharines-Niagara region.

Our streamlined and accessible loan application only takes a few minutes, without any intrusive credit check or invasion of your privacy. Just provide some essential information about your budget, present financial situation, and what you’re looking for, and our sophisticated matching engine will instantly provide you with a custom list of suggested dealers and lenders. For buyers who call the towns of Barrie and Oshawa home, we can take the frustration and hassle out of car loan shopping to help them stay focused on affordable driving.

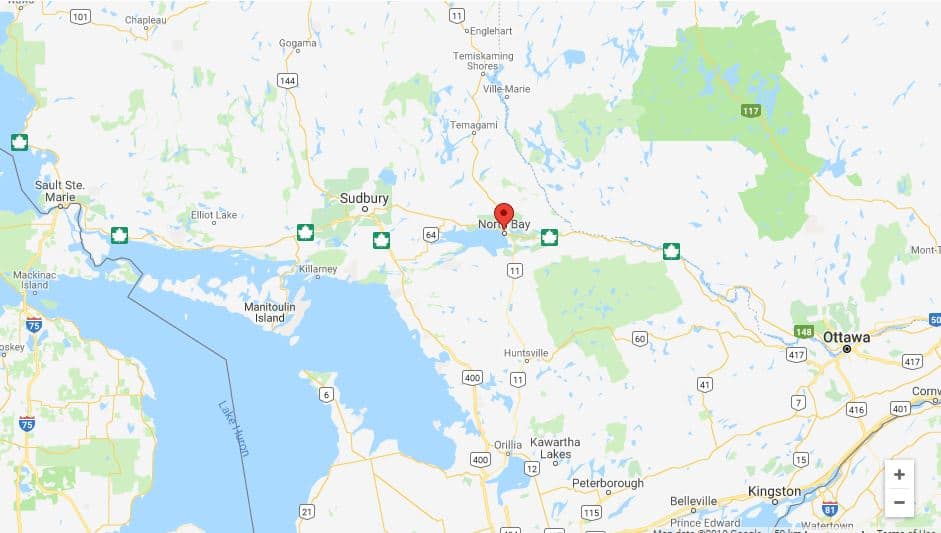

All throughout the process, the top-notch LendingArch support team is there to share insights, information, and expertise. We’ll give you indispensable tools to help you plan ahead—like our handy loan calculator tool, which helps you understand how the sticker price listed might translate to an actual monthly payment. Our support network reaches north to Sudbury, Orillia, and North Bay, all the way to the lakehead city of Thunder Bay. We’re determined to make car loan financing fair, understandable, and sensible for drivers just like you, no matter where you might be located.

Manitoba

In many ways, the province of Manitoba has long been an undiscovered gem—and that’s not just because it’s historically been an industrious mining region. The area’s abundant natural resources have been the cornerstone of Manitoba’s economy, creating tight-knit and thriving communities, big and small, connected throughout this fantastic province.

Dubbed “The Gateway to the West,” the capital city of Winnipeg is a fast-growing, dynamic city that’s home to more than half of Manitoba’s total population. That means increasing numbers of drivers are on the lookout for affordable, reliable vehicles that meet their specific demands.

Manitoba’s winters aren’t for the fainthearted, and drivers in Brandon and towns across the province need powerful cars, trucks, and SUVs ready to withstand those tough sub-zero temperatures. Luckily, LendingArch’s extensive network is there with all the most popular makes and models, from all major manufacturers, with an immense array of dealer options to see Manitoba’s drivers through the coldest winter.

Saskatchewan

Imagine driving across the endless prairies, surrounded by flowing wheat fields under a brilliant blue sky. Saskatchewan is truly Canada’s heartland, offering stirring landscapes and endless stretches of open highway ready for an inspiring and unforgettable road trip.

Our dealer network is ready to serve drivers all across Saskatchewan, from the central cities of Saskatoon and Prince Albert to further south in Regina and Moose Jaw. No need to worry about your credit score or spotty financial history. LendingArch specializes in assisting all drivers, even subprime borrowers and those with no or bad credit, find and secure car loan financing without sacrificing quality in the vehicles they choose.

Alberta

Alberta may be known for stampedes and a massive petroleum industry, but there’s a lot more to this magnificent prairie province than cow rustlers and oilfields. Explore Alberta and discover a vibrant, diverse province with miles and miles of roads to explore and as many different types of drivers as there are vehicles on the market.

In the northern towns of Fort McMurray and Grande Prairie, drivers want trucks and SUVs with all the power and features needed to face northern Alberta’s often harsh elements. Albertans can trust our reliable lender database to point them in the right direction, with loads of options on the best vehicles for every need.

Our extensive network covers the rest of Alberta too, from the burgeoning city of Edmonton to intimate Spruce Grove, down to Red Deer, surrounded by rolling aspen parklands. Serving as Alberta’s hub is sprawling Calgary and neighbouring Airdrie—with this metropolitan region home to over a million residents, that means a lot of drivers clocking miles in need of dependable wheels. In the southern Alberta regions of Medicine Hat and Lethbridge, LendingArch’s services are also available to everyone looking for a top-of-the-line vehicle at the best and fairest rates.

British Columbia

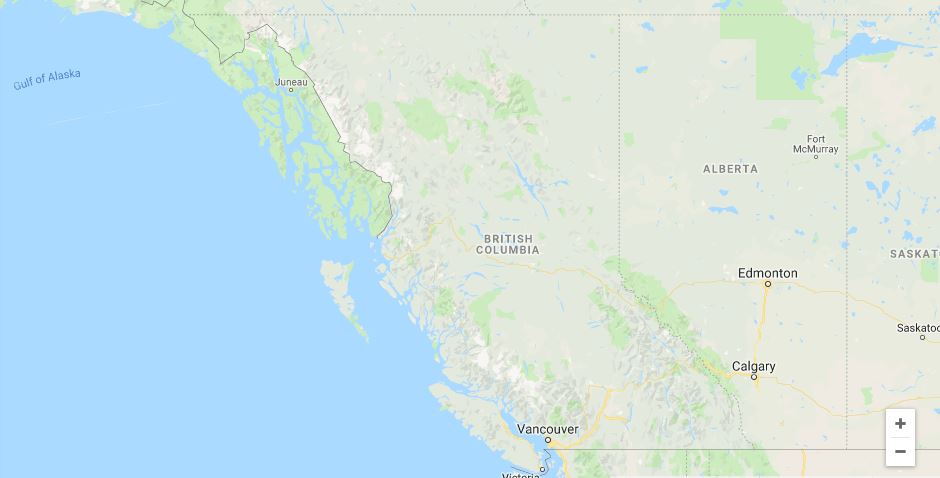

In your journey west across this vast nation, you eventually arrive at the sweeping Pacific coastline. From the spectacular ranges of the Rocky Mountains to the wonders of the coastal forests, British Columbia is truly a place unlike any other.

Drivers residing in British Columbia’s interior know the joys of the province’s natural environment. The wondrous Okanagan Valley, with towns like Kelowna, Penticton, and Vernon, offer endless routes and highways for exploration. From Kamloops to Prince George, the expansion of this region has opened up whole new possibilities for Canada, and LendingArch wants to do the same for its drivers. We’ll get you on the road and ready to take in all the sights and experiences of British Columbia’s mountains and valleys.

LendingArch’s services are available all across British Columbia. We work with top dealers and financing lenders in places further south in the province, like White Rock and Abbotsford, striving to bring our clients the best value on their car loans. Whether you’re looking for a new or used ride, we’ll give you access to the leading dealerships in Chilliwack, Mission, and all over Canada’s westernmost province.

A quick ferry ride across the Georgia Strait is Vancouver Island, site of the beautiful capital city of Victoria as well as Nanaimo and Campbell River. And while dazzling Vancouver is one of the world’s top-ranked cities, it can also be an expensive city to call home—all the more reason to let us support you as you shop around for the best possible deal on financing that new car, or whatever vehicle you have your sights on.

LendingArch: Start Your Journey Today

At LendingArch, we believe there’s a car loan solution for every Canadian. Our goal is to help drivers across Canada cruise past their financial roadblocks to take the wheel of the car they want, assured they’re getting the best possible deal.

Forget about predatory sales schemes or low-interest loans saddled with hidden terms designed to sap you of your last dollar. LendingArch’s model is about creating meaningful connections between drivers and lenders, free of tricks or tactics. With the confidence of easy, fair auto financing on your side, you’ll be ready and able to heed the call of the open road.

No matter where you are in Canada, our expansive network has solutions that suit your needs. With just a few quick questions about your individual situation, we’ll align you with financing options tailored to your specifications. As you browse your options, you’ll get invaluable information on top dealers and lenders who understand the shortcomings of traditional car loan financing. Our partners are ready to work with you, not take advantage of you—particularly if your credit score is presenting a burden.

Life should be about pursuing possibilities, not worrying about interest rates and fine print. That’s why LendingArch puts drivers first. Our ongoing mission is to cut out the frustration and setbacks of car loan financing so you can concentrate on planning your next voyage and the road that lies before you.

Let LendingArch point you toward new destinations. Start your application today and prepare to hit the Canadian highway.