COMPARE LOANS

A little boost to help your finances take off

- Compare over 40 leading brands

- Doesn't harm your credit score

- Know where you stand if you're pre-approved

Compare loans from over 40 lenders, right across the market

We do the heavy lifting, so you don’t have to. We work with a wide range of leading providers to help you borrow the money you need.

What is a loan?

A loan is a type of credit, usually a sum of money that is borrowed and expected to be paid back over an agreed period of time with interest.

When it comes to keeping your financial plans moving, a little boost can make all the difference. A loan could be useful if you need help to reach a goal – whether you’re looking to buy a new car, renovate your home or deal with some existing debts.

We can help find the right loan for you – and this should mean big savings in the interest you pay. Our eligibility checker shows you your chance of being accepted, as well as the guaranteed rate, so you can see all your options.

BestLendorsFor is a credit broker – this means we’ll show you products offered by lenders. You must be 18 or over and a UK resident.

What could you do with a loan?

You can use a loan for a range of purposes, including:

To spread the cost of buying a car

Found your dream car but don’t have the savings to buy it outright? A loan can help you enjoy your new wheels by spreading the cost of the car into manageable repayments.

To sell more quickly with a bridging loan

A bridging loan can help you to buy a new property before you sell your current home, by ‘bridging’ the gap between sale and completion.

To pay for a holiday

Whether your holiday is abroad or in the UK, a holiday loan can help towards the cost of your next adventure if you don’t have the savings to help out.

To make home improvements

Looking to make renovations to your house? From a new kitchen to a new bathroom, a home improvement loan can help fund the cost of home improvements.

To consolidate existing debts

Finding one low interest rate loan for all your debts can bring the ease of having just one payment to deal with instead of different cards and loans on the go (where it may be easy to lose track and miss payments!).

To pay for a wedding

While a wedding may be the best day of your life, it can also be an expensive one! A wedding loan can help manage the cost of your big day and minimise money worries.

What is a loan?

There are different types of loans available depending on your needs. Which loan you can get will depend on your financial situation…

Unsecured or personal loans

An unsecured loan, or personal loan means you don't need to use something you own as collateral. Lenders use your financial history to decide if you qualify and how much you can borrow - it helps if you have a good credit score and have kept up with debt repayments before.

Secured or homeowner loans

With a secured loan or homeowner loan, you put up an asset - usually a property that you own or pay the mortgage on - as security. If you don’t keep up with the repayments, the lender can seize the asset – meaning you could lose your home.

Guarantor loans

Guarantor loans are another option if you have poor or limited credit. They work like a regular loan, except that you need a guarantor when you apply. This is someone (normally a family member) who promises to make your repayments if you miss any.

Am I eligible for a loan with bad credit?

If you have bad credit, your choice of loans may be limited. But this doesn’t mean there aren’t options available.

If your credit score isn’t so good, it can be a tougher process to get a regular loan. With this in mind, a bad credit loan could be an option. These loans are aimed at those with a poor or limited credit history, so they’re easier to qualify for. But they usually have higher interest rates and lower borrowing limits – so they can be more expensive. Comparing with MoneySuperMarket could mean bigger savings in interest by finding a great deal.

Representative 32.3% APR

What will my loan cost?

It’s important for you to work out what your loan will cost you in terms of monthly repayments over the term. Whether you’re looking to take a £5,000 loan or even £15,000, our loans calculator can help you work out how much you can afford to borrow by entering how much you can afford to pay back each month and the length of time you can afford to pay that amount (and at what interest rate.)

It’s worth noting that smaller loans tend to have higher interest rates, which can affect the affordability of your loan – so if you take out a loan over a longer term you should be able to bring the repayments down.

Representative example |

||

|---|---|---|

| Loans Amount | Monthly repayments | Length of agreement |

| £10,000 | £179.07 | 60 months |

| Total amount repayable | Representative | Annual Rate of Interest (nominal) |

| £10,744.50 | 2.9% APR | 2.86% |

Grow your credit score for even better offers

A higher credit score means you’re more likely to be accepted for a wider range of loan rates, so growing your score could give you more offers to choose from.

Check your score with Credit Monitor, then get regular updates and personalised tips to help it grow – all for free.

With a pre-approved loan, the deal you see is the deal you get

When you apply for a loan, it’s not always clear what deal you’ll be offered or whether you’ll be accepted. But when you’re pre-approved for a loan, you know the deal you see is the deal you’ll get – you’ll know where you stand, with information that will help you make the right choice.

Apply with confidence

When you’re pre-approved, the loan amount, duration and interest rate are all confirmed

Tailored to you

When you know what you’ll be able to borrow and how much it will cost, you can choose a loan that’s right for you

You’re in safe hands

This helps protect your credit score as you’re less likely to be rejected when you apply

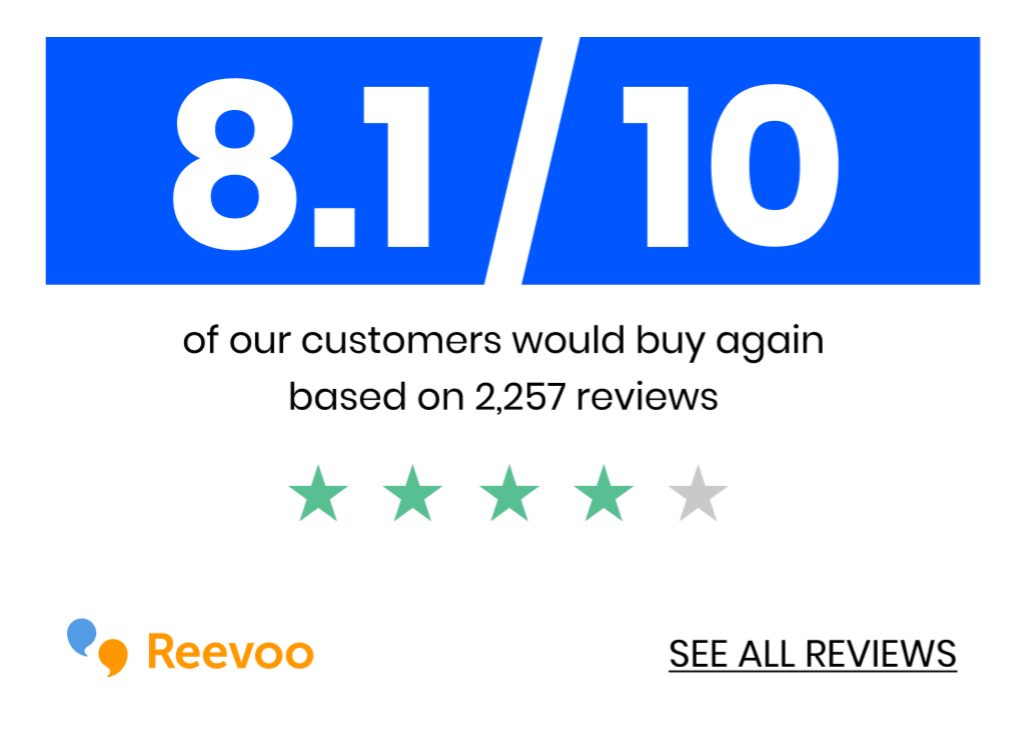

We're 100% independent, working only for our customers

Unlike some of our competitors, MoneySuperMarket is not owned by an insurance company. So we can offer the best value, with savings delivered straight to you.

We combine independence, so we can negotiate the best prices, with excellent technology, to find the best value products and services.

That makes us, in our customers’ opinions, the best price comparison website.

Reporting loan scams

We’re aware that some fraudsters are trying to use the MoneySuperMarket brand to trick consumers into handing over money or financial details, by offering fake loans with eye-catching interest rates.

The best way to stop these scams is to report them.

How do I report a loan scam?

If you think you’ve been contacted by a fraudster, please stop all communication with them and report it to Action Fraud.

If it’s someone impersonating BestLendersFor, please contact our customer services team.

Phone Action Fraud on

0300 123 2040 to report fraud

Find my score

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

What can I take out a loan for?

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

How much can I borrow?

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

How long can I take out a loan for?

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

How do I know if I’m eligible for a loan?

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

A secured loan is a loan you can take out that’s tied to an asset of yours as security. For example a mortgage is a type of secured loan, and the asset would be the house you take the mortgage out on – when you repay the loan the house is yours, but if you don’t repay then the lender could seize your house.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.

An unsecured loan isn’t tied to any collateral, and as a result you normally need at least a fair credit score to qualify. There is also often a maximum amount you’ll be allowed to borrow.