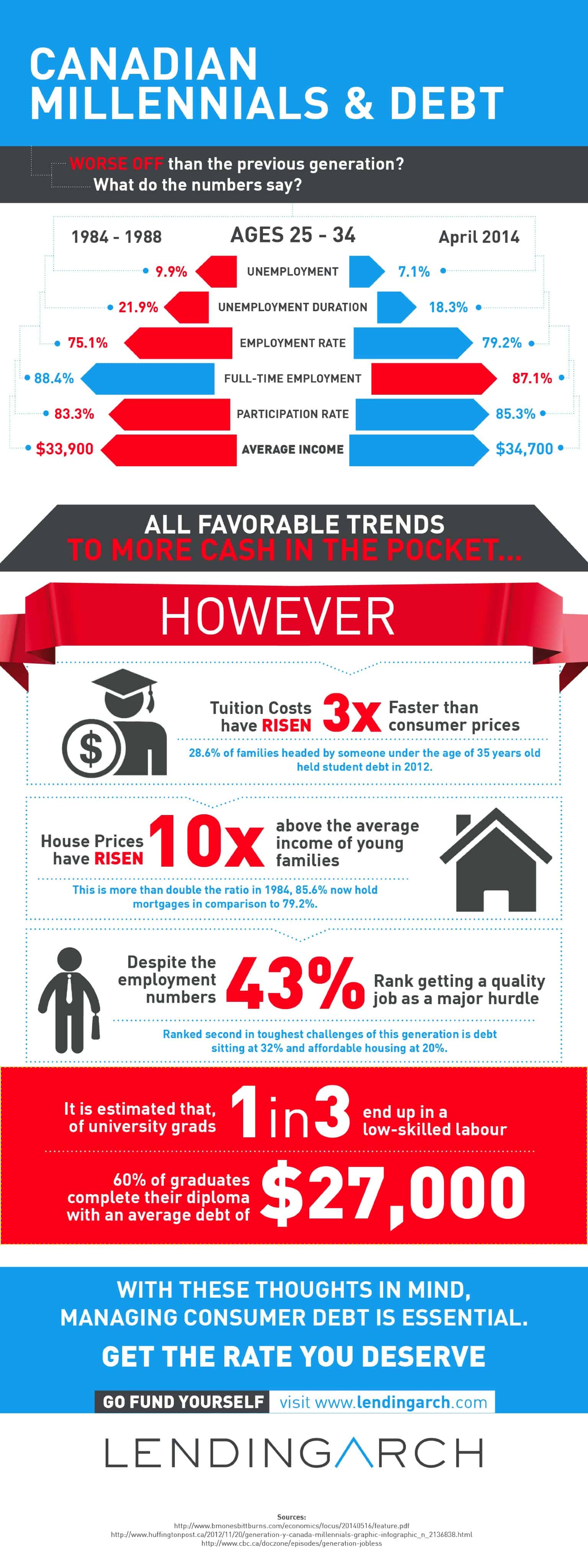

Debt levels of the millennial generation – compared to the available opportunity for success – has been a trending topic across the web for years now. Countless articles have been written from all different schools of thought, one side articulating the hardships faced by Gen Y and the other claiming how easy us millennials have it. LendingArch did some digging on the current economic outlook in comparison to the same age groups of the past, we like to let facts speak for themselves.

About The Author

lending

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.